Detailed Guide on EPF Form 3A: Filing and Filling Procedures

Detailed Guide on EPF Form 3A: Filing and Filling Procedures

Detailed Guide on EPF Form 3A: Filing and Filling Procedures

Introduction to EPF Form 3A

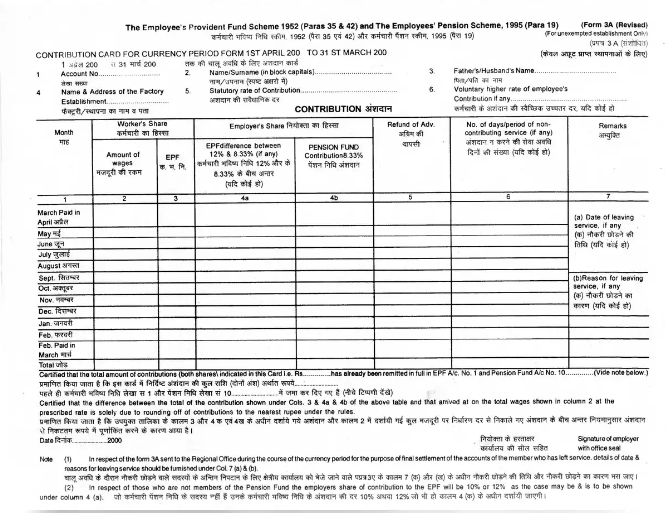

EPF Form 3A, officially known as the “Employee’s Annual Contribution Card,” is a crucial document under the Employees’ Provident Fund (EPF) scheme. This form serves as an annual summary of the contributions made by both the employer and the employee towards the EPF and Employees’ Pension Scheme (EPS). It is used to maintain transparency and accuracy in recording the contributions for each financial year. The accurate filling and timely submission of Form 3A are essential for statutory compliance and ensuring the proper management of an employee’s retirement savings.

Key Components of EPF Form 3A

- Employee Details:

- Name: The full name of the employee as registered with the EPFO.

- EPF Account Number: A unique identifier assigned to the employee under the EPF scheme.

- Father’s/Husband’s Name: This information helps in the identification of the employee.

- Name of the Establishment: The name of the company or organization where the employee is employed.

- Contribution Details:

- Monthly Contribution Breakdown: A detailed record of the monthly contributions made by both the employer and the employee. This includes the basic wages, dearness allowance, and any other allowances on which EPF contributions are calculated.

- Employee’s Share: The amount contributed by the employee.

- Employer’s Share: The amount contributed by the employer, including the segregation of EPF and EPS contributions.

- Voluntary Contributions: If any voluntary provident fund contributions are made by the employee, they are recorded here.

- Total Contribution:

- Cumulative Totals: Summarizes the total contributions made over the financial year, including the employee’s and employer’s shares.

- Signatures and Certification:

- The form requires the signature of the employer or an authorized signatory to certify the accuracy of the details provided.

Filing Procedure for EPF Form 3A

- Preparation of the Form:

- The employer must gather all relevant details for each employee covered under the EPF scheme. This includes ensuring that all contributions have been accurately recorded each month.

- Prepare a separate Form 3A for each employee, detailing their contributions for the financial year.

- Annual Submission:

- Form 3A must be completed and submitted to the EPFO by April 30th of each year, along with Form 6A, which is a consolidated annual statement of contributions for all employees.

- The submission can be made through the employer’s EPFO portal or physically to the EPFO regional office, depending on the method specified by the EPFO.

- Record Keeping:

- Employers are required to keep copies of Form 3A for their records, as this form may be needed for audits or for resolving discrepancies in the future.

- Employees should also verify their EPF passbook to ensure that the contributions reflected match those reported in Form 3A.

- Penalties for Non-Compliance:

- Failure to submit Form 3A on time can lead to penalties and legal consequences for the employer. It is crucial to adhere to the deadlines and maintain accurate records to avoid any issues.

Filling Procedure for EPF Form 3A

- Employee Information Section:

- Begin by entering the employee’s personal details, including their name, EPF account number, and other identifiers.

- Ensure that the details match those in the EPFO records to avoid discrepancies.

- Contribution Details Section:

- Accurately record the monthly contributions made by both the employer and the employee. This should include the employee’s share, employer’s share, and any voluntary contributions.

- Enter the basic wages, dearness allowance, and other allowances on which the contributions are calculated.

- Cumulative Totals:

- Add up the monthly contributions to get the total contributions for the year. This cumulative total should match the amount reflected in the employee’s EPF passbook.

- Certification:

- Once all details are filled in, the form must be signed by the employer or an authorized signatory. This signature certifies that the information provided is accurate and complete.

- Submission to EPFO:

- Submit the completed Form 3A, along with Form 6A, to the EPFO by the stipulated deadline.

This is how Form 3A look like:-

Conclusion

EPF Form 3A is a vital document in maintaining the transparency and accuracy of contributions towards an employee’s provident fund and pension scheme. For employers, understanding the importance of this form, the correct procedure for filling it out, and the timely submission of it is crucial for ensuring compliance with EPF regulations. Employees, on the other hand, benefit from the assurance that their retirement savings are being managed correctly and that the contributions made on their behalf are accurately recorded.

Frequently Asked Questions

A: EPF Form 3A, also known as the Employee Provident Fund Annual Contribution Card, is a crucial document that details an employee’s EPF contributions for the financial year. It records both the employee’s and the employer’s contributions to the Provident Fund, as well as details of the employee’s monthly wages.

A: The employer is responsible for filling out and submitting Form 3A. The form must be completed accurately with details of each employee’s contributions for the entire financial year and is submitted to the Employees’ Provident Fund Organization (EPFO) at the end of the financial year.

A: EPF Form 3A requires the following information: employee details (such as name, PF account number, and date of joining), monthly contributions from both the employee and employer, monthly wages, and any other relevant details regarding the employee’s Provident Fund for the financial year.

A: EPF Form 3A must be submitted annually by the employer at the end of the financial year. This form is a part of the annual return filing process and must be submitted to the EPFO by the due date specified for that financial year.

A: Employees can access their Form 3A details through their employer or by logging into the EPFO member portal. The form provides a detailed record of the employee’s EPF contributions for the financial year, which can be used for future reference or when making claims.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.