Understanding EPF Form 2 Part B: A Comprehensive Guide

When it comes to managing your Employee Provident Fund (EPF), it’s crucial to understand the significance of EPF Form 2 Part B. This part of the form plays a pivotal role in securing the financial future of your dependents under the Employees’ Pension Scheme (EPS). Let’s dive deep into what EPF Form 2 Part B entails, why it matters, and how to fill it out accurately.

What is EPF Form 2 Part B?

EPF Form 2 Part B is dedicated to the nomination process under the Employees’ Pension Scheme (EPS). This form ensures that in the event of your demise, the pension benefits are transferred to your chosen nominees. This section of the form specifically focuses on pension distribution and is separate from the EPF proceeds, which are covered in Part A.

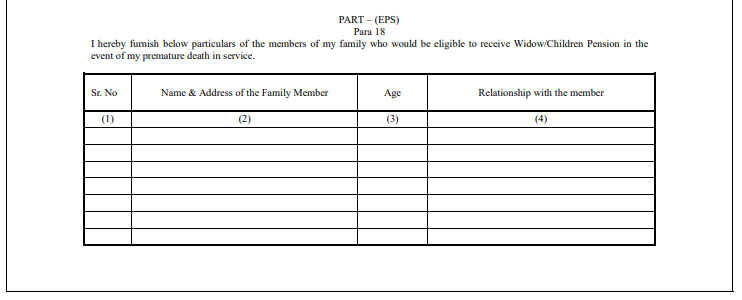

Key Components of Part B (EPS Proceeds)

1. Nominee Information:

- Name of the Family Member: List the names of the family members who will be eligible to receive the pension benefits.

- Address of the Family Member: Provide the complete residential address of the nominees.

- Date of Birth: Mention the birth date of each nominee to ensure accurate identification.

- Relationship with the Member: Specify the relationship of the nominee with you (e.g., spouse, child, dependent parent).

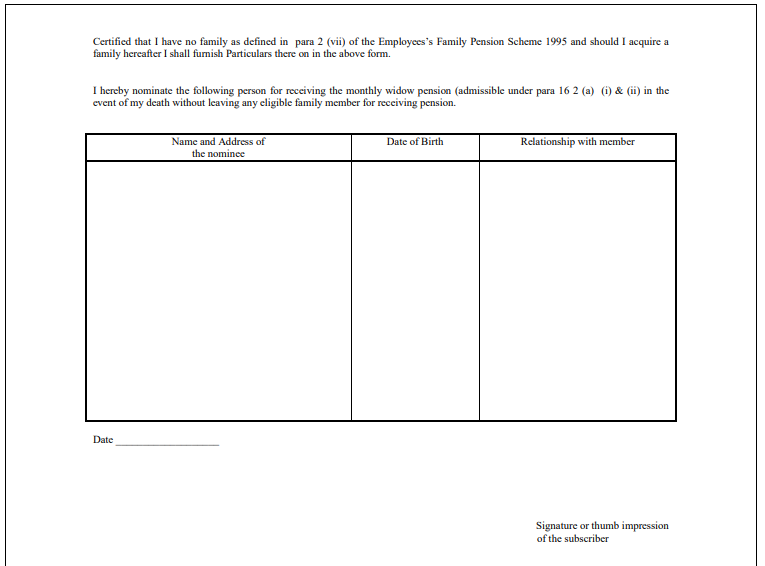

2. Widow Pension Nomination:

- If you are nominating for a monthly widow pension, additional details such as the nominee’s name, address, and relationship with you must be provided.

3. Signature or Thumb Impression:

- The form must be signed or thumb-impressed by you, the EPF member, to authenticate the nomination.

Certification by the Employer

After you have filled out the form, it needs to be certified by your employer. The certification involves the following:

- Employee Details: Your employer will verify your details, including your name and employment status.

- Authorized Officer’s Signature: An authorized officer from your organization will sign the form.

- Designation and Details: The officer’s designation, the date, and the place of certification must be clearly mentioned.

- Organization’s Details: The name, address, and official stamp of the organization will be included to validate the nomination.

Guidelines for Nominating Family Members via EPF Form 2

For Male Employees:

- Eligible nominees include your wife, dependent parents, children, and the widow and children of your son.

For Female Employees:

- You can nominate your husband, dependent parents, children, and your husband’s dependent parents, along with the widow and children of your son.

Under the Employee’s Pension Scheme (EPS):

- The family definition extends to the spouse and minor or unmarried children. In cases where a child is adopted before the member’s death, the adopted child is also eligible.

How to Fill Out the e-Nomination Online

The EPFO has made it easier to fill out nominations online. If you have a registered UAN, you can complete the e-nomination process through the EPF member portal. Here’s how:

- Login to the Portal: Use your credentials to access the EPF member portal.

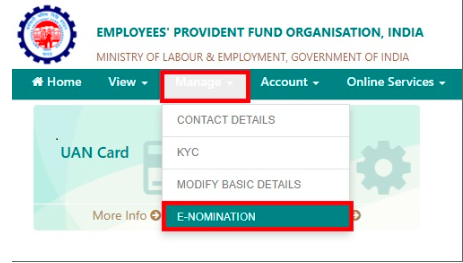

- Select e-Nomination: Navigate to the “e-Nomination” option under the “Manage” section.

- Update Profile: Fill in your permanent and current addresses, then save the information.

- Add Nominees: Enter the Aadhaar number, name, date of birth, gender, and relationship of your family members. You can add multiple nominees by selecting “Add Row.”

- Allocate Shares: Specify the percentage of the pension each nominee should receive, then save the nomination.

- Confirm EPS Nomination: Follow the same steps for Part B to ensure your pension benefits are accurately allocated.

Offline Nomination Process

If you prefer to handle the nomination offline, you can fill out Form 2 manually and submit it to your employer. Once the form is submitted, the nomination details will be updated in your EPF account, ensuring that your nominees receive the benefits as per your wishes.

Important Considerations When Nominating Family Members

- Flexibility: You can change your nomination at any time, and there’s no limit on the number of updates.

- Family Focus: Nominations must be made in favor of family members. If you don’t have a family, you are free to nominate anyone.

- Multiple Nominees: You can nominate more than one family member, specifying the percentage of the fund each nominee will receive.

- Pension Eligibility: A minimum of 10 years of service is required to avail of the pension benefits under EPS.

- Family Restrictions: If you have family members, you cannot nominate someone outside of the family.

Conclusion

Filling out EPF Form 2 Part B is a critical step in ensuring that your loved ones are financially secure in your absence. By carefully selecting and nominating your family members, you can ensure that your pension benefits are distributed according to your wishes. Whether you choose to complete the nomination process online or offline, make sure that all details are accurately filled out and regularly updated to reflect any changes in your family situation.

Frequently Asked Questions

A: EPF Form 2 Part B is used to nominate family members for the Employee Pension Scheme (EPS). It ensures that in the event of the member’s death, the pension benefits are distributed to the nominated family members according to the details specified in the form.

A: Under EPF Form 2 Part B, you can nominate your spouse, dependent parents, children, or other close family members. For male employees, this typically includes the wife, dependent parents, and children. For female employees, this includes the husband, dependent parents, and children.

A: Yes, you can change your nominations at any time by submitting a new Form 2. There is no limit on the number of times you can update your nominations, allowing you to adjust them as your family situation changes.

A: Yes, it is mandatory to nominate family members under the Employee Pension Scheme (EPS) as defined by the EPF rules. If you do not have a family, you are allowed to nominate other individuals.

A: You can file EPF Form 2 Part B online through the EPF member portal. After logging in with your UAN, you can access the “e-Nomination” section, update your family details, and save the nomination. This process helps in ensuring that your nominations are securely recorded in the EPF system.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.