Comprehensive Guide on Handling Income Tax Intimation Under Section 143(1)

Received an intimation under Section 143(1) from the Income Tax Department? Don’t worry! This document isn’t always a cause for concern or an indication that you owe additional taxes. In fact, it could sometimes be a notification of a refund that you are entitled to receive soon. Let’s explore what this intimation is, why it is issued, how to handle it, and the steps you should take once you receive it.

What Does an Intimation Under Section 143(1) Mean?

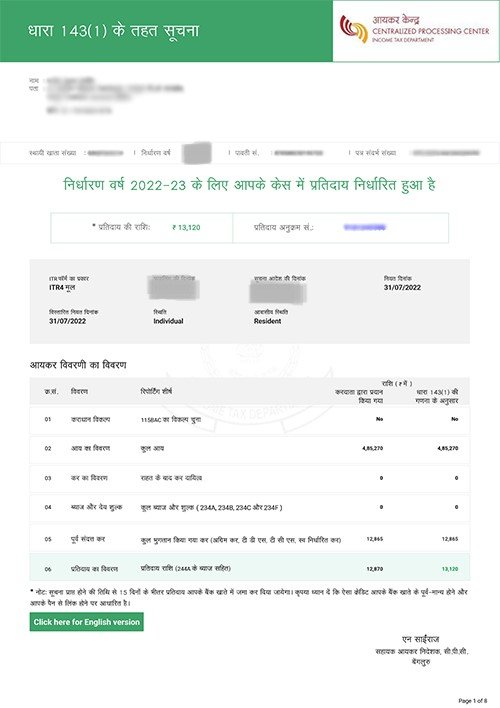

An intimation under Section 143(1) is issued by the Income Tax Department once your Income Tax Return (ITR) is processed. It summarizes the details submitted in your return, and highlights any discrepancies, adjustments, or additional tax liability or refunds due. This intimation is auto-generated through a computerized process and requires careful review to ensure accuracy.

Why is an Intimation Issued Under Section 143(1)?

When you submit an ITR, the Income Tax Department performs a preliminary assessment using automated checks to validate the data. The intimation is issued for various reasons, including:

- Mathematical Errors or Inconsistencies: If there are calculation errors or inconsistencies in the return.

- Incorrect Claims or Deductions: If deductions or exemptions claimed exceed the permissible limits or if there is a mismatch with the information available to the department.

- Verification of Tax Payments: Comparison of advance tax, self-assessment tax, and TDS data against records held by the department.

- Additional Income Identified: Any income reported in Form 26AS, Form 16A, or Form 16 that was not included in the ITR.

- Late Submission Issues: Claims for loss carry forward or deductions made after the due date for filing.

When Can You Expect an Intimation Under Section 143(1)?

You will typically receive an intimation under Section 143(1) in the following situations:

- Refund Due: When the taxpayer has overpaid taxes, and a refund is due.

- Demand for Additional Tax: If there is a shortfall in the taxes paid, the notice will include details of the outstanding amount.

- Confirmation of Return: If the return is accepted as filed without any changes, the intimation serves as confirmation.

Time Frame for Receiving Intimation Under Section 143(1)

The Income Tax Department must issue the intimation within 9 months from the end of the financial year in which the return is filed. For example, if a return for the financial year 2023-24 is filed on July 21, 2024, the intimation can be issued up to December 31, 2025.

What Actions Should You Take Upon Receiving Intimation Under Section 143(1)?

If you receive an intimation under Section 143(1), you should:

- Verify the Details: Review the intimation carefully to ensure that all details, such as your name, PAN, and assessment year, match your records.

- Check for Errors or Discrepancies: Compare the department’s calculations with the figures submitted in your return. If there are errors or discrepancies, consider filing a revised return or a rectification request under Section 154.

- Respond Accordingly:

- If there is a demand, pay the additional tax within the stipulated time to avoid penalties.

- If you disagree with the demand, file an online rectification application.

- Seek Professional Help: If you are unsure about the notice or how to respond, consult a tax professional to avoid any adverse consequences.

Steps to Respond to Intimation Under Section 143(1)

To respond to the intimation, follow these steps:

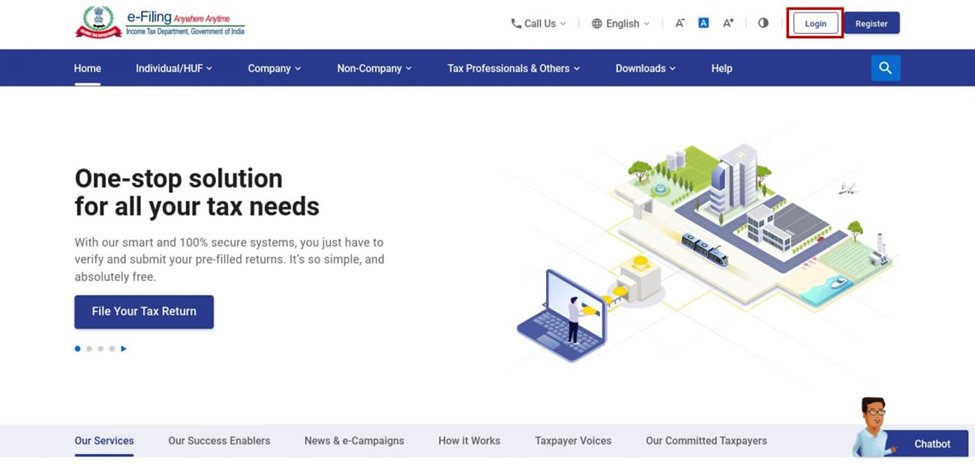

- 1.Log in to the Income Tax e-filing portal.

- 2.Navigate to the “Pending Actions” tab, select “e-Proceedings,” and choose “e-Assessment.”

- 3.Review the notice details and select the appropriate response for any discrepancies.

- 4.Submit supporting documents if required and confirm your response.

What If You Do Not Receive an Intimation?

If no intimation is received within one year from the end of the financial year in which the return was filed, the ITR-V acknowledgment will be considered as the intimation. However, it is advisable to check online whether your ITR has been processed.

How to Obtain the Intimation Again?

1.Login

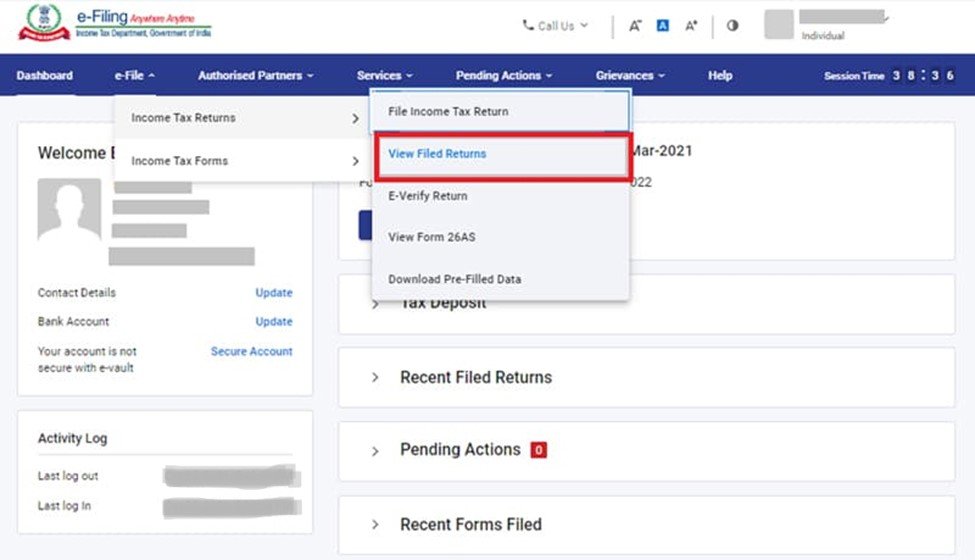

2.Click Services-View Filed Returns

3.Download Intimation Order Dated At

If you have not received the intimation or have misplaced it, you can retrieve it by logging into the Income Tax e-filing portal, navigating to “View Filed Returns,” and downloading the intimation order.

Password to Open Intimation Under Section 143(1)

The intimation document is password-protected. The password is a combination of your PAN (in lowercase) followed by your date of birth in the format DDMMYYYY. For example, if your PAN is AAGRK5803P and your date of birth is November 2, 1982, the password will be “aagrk5803p02111982.”

Key Points to Verify in the Intimation

- Ensure the intimation is addressed to you with correct personal details.

- Verify all incomes are categorized under the correct heads and calculations are accurate.

- Confirm that TDS, advance tax, and self-assessment tax payments are accounted for correctly.

Conclusion

Receiving an intimation under Section 143(1) is a routine part of the tax assessment process. It is crucial to review the details carefully and take the necessary steps promptly to comply with the notice. Whether the intimation is for a refund, additional tax payment, or just a confirmation, addressing it in a timely and accurate manner will help you avoid penalties and ensure that your tax matters are in order.

If you find handling such notices challenging, consider seeking assistance from a tax professional to help you navigate the complexities of tax compliance.

Frequently Asked Questions

A: Section 143(1) refers to a formal communication issued by the Income Tax Department once an individual’s tax return has been processed. This intimation acts as a preliminary review of the taxpayer’s financial information to ensure that the details provided in their tax return match the department’s calculations. Essentially, it verifies the accuracy of the tax return and identifies any discrepancies in the taxpayer’s reported income, deductions, and tax payments.

A: The Income Tax Department typically sends the intimation under Section 143(1) to your registered email address with a subject line like “Your Income Tax Return (ITR) Intimation.” Additionally, an SMS alert is sent to your registered mobile number, notifying you that the intimation has been dispatched to your email. Make sure your contact details are up to date to avoid missing such important communications.

A: No, an intimation under Section 143(1) is not an assessment order. It simply notifies the taxpayer that their return has been processed by the Income Tax Department. It is a preliminary check and does not constitute a final assessment of your tax liability.

A: To access the intimation under Section 143(1), you need to use a specific password format. This password is a combination of your PAN and your date of birth. For instance, if your PAN is AAGRK5803P and your date of birth is November 2, 1982, your password would be formatted as: “aagrk5803p02111982”. This password is used to open the password-protected document containing your intimation details.

A: To file a rectification request for an intimation under Section 143(1), follow these steps:

- Log In: Access your account on the income tax e-filing portal.

- Navigate to Rectification: Go to the ‘Services’ tab and select ‘Rectification’.

- Select Assessment Year: Choose the relevant Assessment Year for which you need to file the rectification.

- Submit Rectification: Complete the required details and submit your rectification request.

This process allows you to correct any discrepancies identified in the intimation and ensure that your tax records accurately reflect your filings.

A: If your intimation under Section 143(1) shows no discrepancies, no tax demands, and no refund due, it is generally safe to disregard the notice. This indicates that your income tax return has been processed successfully by the Income Tax Department, and no further action is required on your part.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.