All About EPF Form 5: Eligibility, Usage, and Application Process

The Government of India has announced an extension of the employer and employee contributions to the EPF accounts of eligible employees for an additional three months, from June to August 2024. This extension benefits establishments with up to 100 employees, where at least 90% of the workforce earns a salary below ₹15,000 per month. For non-government organizations, the EPF contribution rate has been reduced from 12% to 10%. The EPF interest rate for FY 2023-24 is set at 8.25%.

Both employers and employees need to interact with the Employees’ Provident Fund Organization (EPFO) through designated forms. These forms are essential for carrying out specific transactions with EPF accounts, whether it’s for enrollment, claims, or other updates. One such crucial form is EPF Form 5. Let’s explore its purpose, who needs it, and how to use it effectively.

Understanding EPF Form 5

EPF Form 5 is a mandatory submission by employers, detailing new employees eligible for EPF benefits during the previous month. This form is submitted monthly to the EPF Commissioner’s office. It includes information about employees who qualify for the EPF, Employees’ Pension Scheme, and Employees’ Deposit Link Insurance Scheme for the first time in a given month. Once submitted, a Universal Account Number (UAN) is generated for each employee, allowing the EPF contributions from both employee and employer to be credited to the respective accounts.

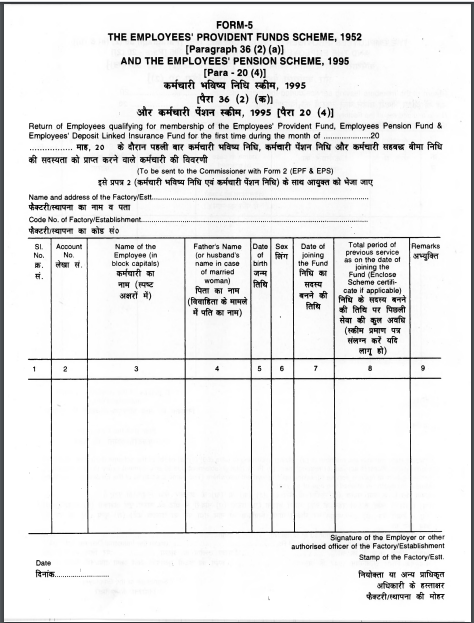

Format of EPF Form 5

The structure of Form 5 is straightforward. It requires the following information:

Employer Information:

- Name and address of the establishment or factory

- Code number of the establishment/factory

Employee Information Table:

- Account number

- Employee’s full name

- Father’s or husband’s name

- Date of birth

- Gender

- Date of joining the EPF fund

- Total previous service period (along with a Scheme Certificate, if applicable)

- Remarks (if any)

Authorization Details:

- Signature of the employer or authorized officer

- Official stamp of the factory/establishment

- Date of form submission

- Date of filing the form

Downloading and Submitting EPF Form 5

Employers can easily download EPF Form 5 from the official EPFO website or from the provided link here-https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form5.pdf

When filling out the form, employers should reference Form 2 and Form 11 for employee nominations and basic EPF details. It’s crucial to submit the completed Form 5 to the EPF Commissioner’s office by the 25th of every month, listing the details of employees who joined during the previous month.

This form is a vital tool for ensuring that new employees are properly enrolled in the EPF system, securing their benefits and contributions from the outset.

Pro Tip: Filing your EPF forms accurately and on time helps maintain compliance and ensures your employees’ contributions are seamlessly processed.

Whether you’re a small business owner or managing a larger workforce, understanding and efficiently handling EPF submissions like Form 5 is essential to maintaining smooth operations and taking care of your employees’ future.

Frequently Asked Questions

A. No, you don’t need to worry about Form 5. It’s the employer’s duty to complete and submit this form. As an employee, you’re not required to take any action on this. The employer handles everything related to Form 5 to ensure your EPF account is set up properly.

A. If your startup employs more than 20 people, you are required to register under the EPFO. In this situation, you must fill out Form 5 with details of all eligible employees and submit it to the EPF Commissioner’s office.

A. Even if there haven’t been any new hires in the past month, you still need to submit Form 5. In this case, simply write ‘Nil’ in the section for employee details and send the form to the EPF Commissioner’s office as usual.

A. For an employee who joined on January 28th, you should include her information in Form 5 and ensure it’s submitted by February 25th, 2024.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.