EPF Form 10D: A Comprehensive Guide to Applying for Your Pension

EPF Form 10D:

If you’re approaching retirement and looking to withdraw your pension, or if you’re considering an early pension, it’s essential to understand the process and requirements for submitting EPF Form 10D. This form is your gateway to claiming your pension benefits under the Employees’ Pension Scheme (EPS). Below, we’ll guide you through the process of applying for your EPF pension, including instructions on how to download, fill out, and submit Form 10D, either offline or online.

Eligibility for EPF Pension

All members of the Employees’ Provident Fund Organisation (EPFO) are automatically enrolled in the EPS. Under this scheme, you become eligible to receive a pension upon reaching the age of 58. Alternatively, you may opt for a reduced pension starting at the age of 50, with a 4% reduction for each year below 58. The pension amount you receive will depend on your pensionable salary and total years of service.

Purpose of EPF Form 10D

EPF Form 10D is specifically designed for employees or their nominees to claim the pension benefits after retirement. Whether you seek a full pension upon reaching 58 years of age or a reduced pension after turning 50, this form is your necessary step to initiate the process.

Where to Submit EPF Form 10D

The form must be submitted to the EPFO through your last place of employment. Currently, the form is available for offline submission only.

Who Should Fill Out EPF Form 10D?

The form is to be completed by:

- The employee (for pension claims after retirement)

- The widow/widower (in the event of the employee’s death)

- The nominee or guardian (if applicable)

- Dependent parents (if the member dies without a spouse, children, or nominee)

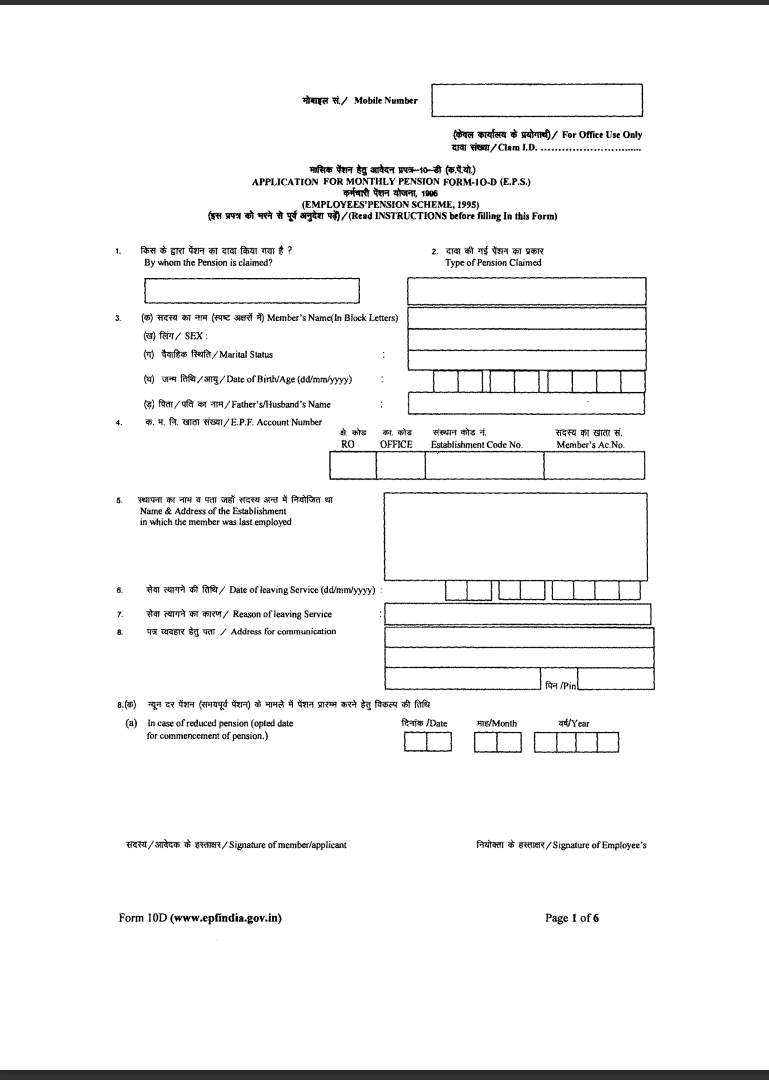

Details Required in EPF Form 10D

When filling out the form, the following information is required:

Claimant’s Details:

- Name, date of birth, and marital status

- Relation to the member (if applicable)

- Contact information, including a mobile number for status updates

Type of Pension:

- Superannuation Pension: Full pension at the age of 58

- Reduced Pension: Available from age 50 at a 4% discount per year

- Disablement Pension: For those who suffer permanent and total disablement

- Widow/Widower & Children Pension: After the death of the member

- Orphan Pension: For surviving children up to 25 years old

- Nominee Pension: For the designated nominee if there are no family members

- Dependent Parent Pension: If the member dies without a family or nominee

Member Details:

- Name, gender, marital status

- Father’s or husband’s name

- EPF account details, including the establishment code and member account number

Employment Information:

- Name and address of the last establishment where the member was employed

- Date and reason for leaving the service

Pension Details:

- Bank account details for pension disbursal

- Nominee details for the return of capital

- Option for commutation of 1/3 of the pension amount

Family Details:

- Details of family members, including their relationship with the member

Additional Information (if applicable):

- Details of any Scheme Certificates held

- Previous pension claims under EPS 1995

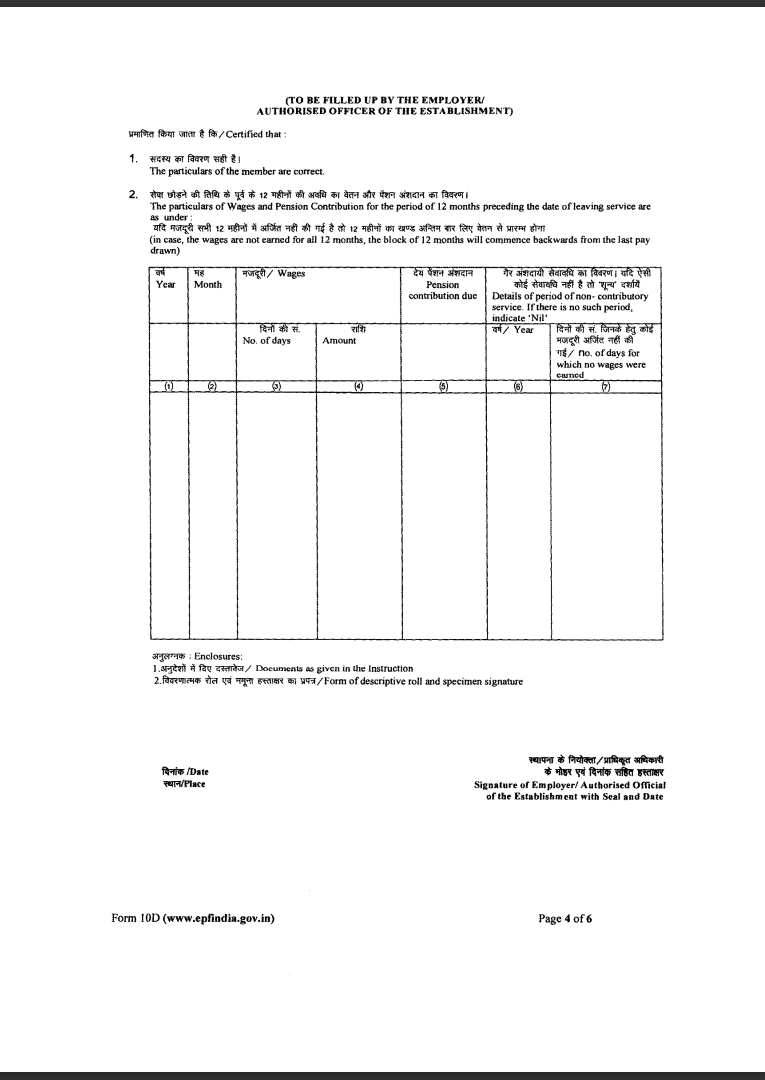

Employer’s Role in EPF Form 10D

The employer is responsible for certifying the details provided by the applicant. The employer must also fill out additional information, including:

- Wage particulars and pension contributions for the 12 months preceding the date of leaving service

- Details of any non-contributory service periods

- Descriptive roll of the pensioner, including a specimen signature or thumb impression

Once completed, the employer forwards the form to the EPFO regional office for processing.

Documents Required with EPF Form 10D

- Descriptive roll of the pensioner with a specimen signature/thumb impression (in duplicate)

- Three passport-sized photographs

- For claims due to disablement, a complete medical examination report from the EPFO-appointed Medical Board

- Wage and service details at the time of retirement or death

- If the establishment is closed, the application must be certified by a magistrate, gazetted officer, bank manager, or another authorized official.

Submission and Processing

Once all required details are filled in and verified by the employer, the form, along with the necessary documents, is submitted to the EPFO. Upon verification, the EPFO initiates the pension disbursal process, with the monthly pension credited to the beneficiary’s bank account under the Employees’ Pension Scheme.

Final Thoughts

Accurately completing and submitting EPF Form 10D is crucial for ensuring that you or your beneficiaries receive the pension benefits you are entitled to. By following the guidelines above and ensuring that all necessary details and documents are provided, you can streamline the process and avoid unnecessary delays.

Frequently Asked Questions

A: The Form 10D application can be submitted through several channels, including:

- Bank managers

- Certified officials

- Gazetted officers

- Magistrates or their authorized representative

A: Claims using EPF Form 10D can be made by specific individuals, including EPF members, surviving spouses, orphans, legal guardians, designated nominees, or dependent parents.

A: Retirees have the choice to take a lump sum payment of up to 30% of their total pension fund. The remaining amount is then used to provide a reduced monthly pension.

A: Yes, your employer must validate and sign Form 10D to confirm your details before you can proceed with your pension claim.

A: The Employees’ Provident Fund Organization (EPFO) typically requires about 30 days from the submission date to process and disburse the pension to the beneficiary.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.