EPF Form-19

The Employees’ Provident Fund (EPF) is a retirement savings scheme supported by the government, in which both public and private sector employees contribute a portion of their salary monthly. Employers match these contributions to individual EPF accounts.

Employees can withdraw these funds upon retirement, if they are unable to continue working due to health reasons, or after leaving a job. To withdraw the EPF account balance in specific situations, Form 19 needs to be accurately completed and submitted.

Latest Updates on PF

If an employer deducts but fails to deposit the employee’s PF contribution, this will not be allowed as a deduction for the employer.

When Should You Use Form 19?

Form 19 is used for withdrawing EPF funds as a final settlement. It can also be used to withdraw pension benefits or obtain a PF non-refundable advance. The first two options are available upon leaving employment, either due to retirement or other reasons. The third option is available during employment, under certain conditions.

How to Use Form 19

Form 19 should be submitted at least two months after leaving a job. Here’s how to fill it out:

How Does Form 19 Look?

Form 19 consists of two pages. The first page collects your personal and contact information and preferred mode of payment, including:

- Name, father’s/husband’s name, and date of birth

- Name and address of the factory/establishment

- PF account number and/or Universal Account Number (UAN)

- Date of leaving the service and reason for leaving

- Permanent Account Number (PAN)

- Full postal address

- Mode of payment (money order at your expense, account payee cheque, or electronic payment)

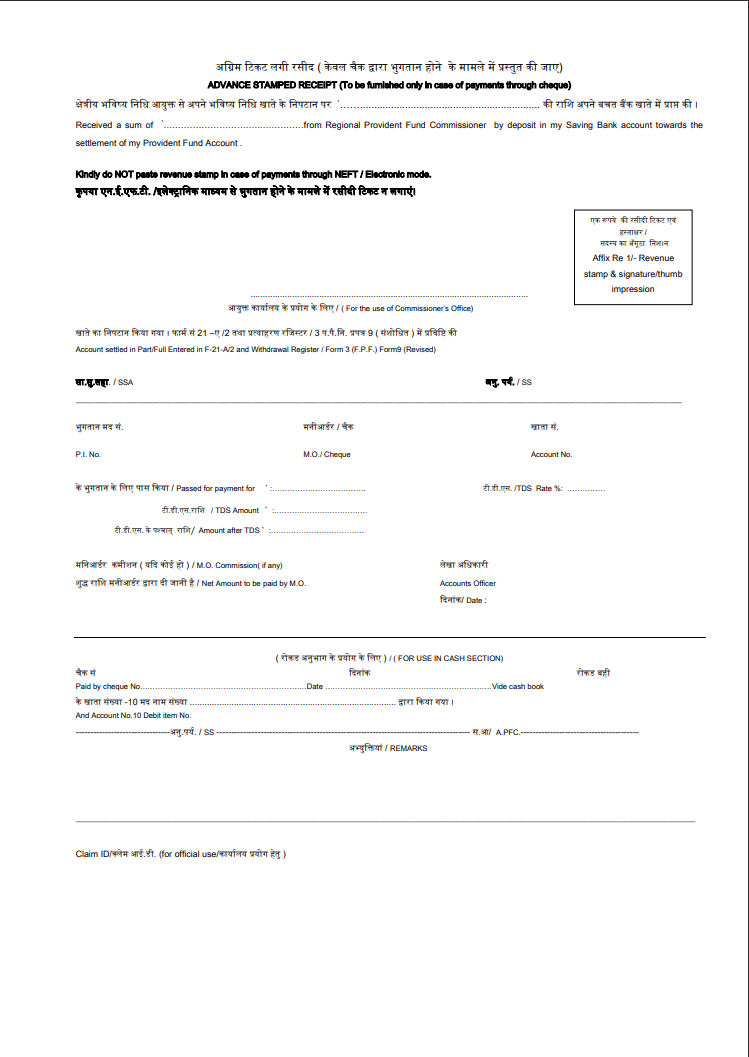

The second page is an advance stamped receipt to be filled if you choose a cheque for payment, requiring a revenue stamp of Rs.1.

Download EPF Form 19

You can download EPF Form 19 here.

How to Fill Form 19 Online

Visit the EPF Member Portal: Go to EPF Member Portal.

1.Log In: Enter your UAN, password, and captcha to sign in.

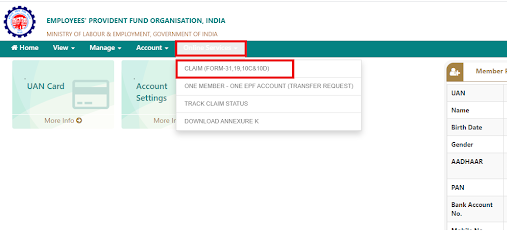

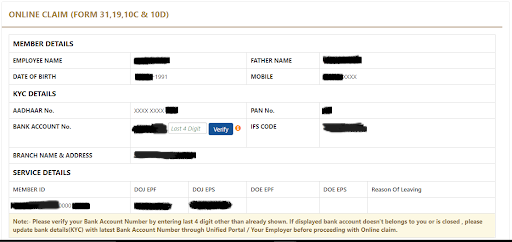

2.Select Claim Form: Under ‘Online Services’, choose ‘Claim Form – 31, 19, 10C & 10D’.

3.Auto-Filled Form: You will see an auto-filled form with your personal details. Verify these details.

4.Verify Bank Details: Confirm your bank account details by entering the last four digits of your bank account number and clicking ‘Verify’.

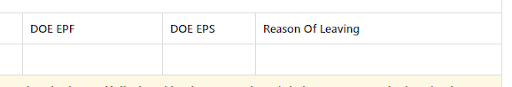

5.Enter Details: Provide the Date of Ending (DOE) EPF and EPS accounts and the reason for leaving.

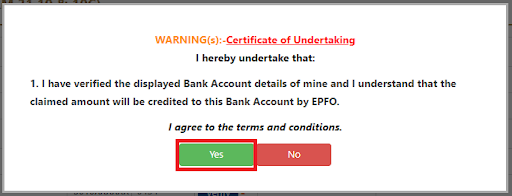

6.Certificate of Undertaking: Select ‘Yes’ to sign the Certificate of Undertaking.

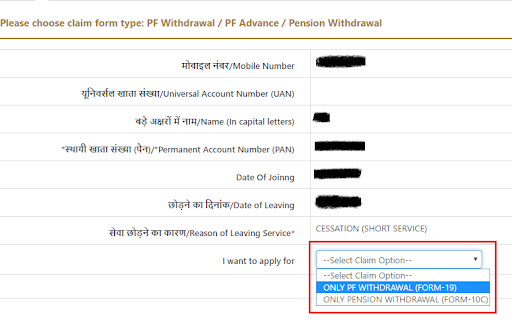

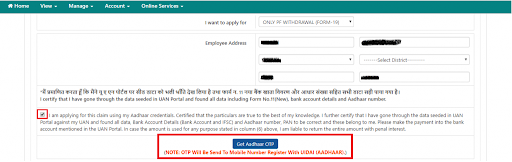

7.Apply for PF Withdrawal: From the drop-down menu, select ‘Only PF Withdrawal (Form 19)’.

8.Enter Address and Disclaimer: Provide your full postal address, accept the disclaimer, and click ‘Get Aadhaar OTP’.

9.OTP Verification: Enter the OTP sent to your registered mobile number.

10.Submit Application: Submit the form.

11.Reference Number: A reference number will be displayed upon successful submission.

12.Receive Funds: The PF amount will be deposited into your bank account linked with the UAN.

Pre-requisites for Filing Form 19

Before applying for withdrawal using Form 19, ensure you have:

- Activated your UAN on the EPF Member portal.

- Linked your UAN with your bank account and PAN.

- Linked your mobile number with UAN.

- Verified eligibility for final settlement (the form will not be displayed if you are not eligible).

- Left the job at least two months prior to filing.

- Provided a mobile number (mandatory for final settlement).

- Provided a PAN (mandatory for claiming final settlement).

Withdrawing EPF Funds Offline – Composite Claim Form

The composite claim form combines Forms 19, 31, 10C, and 10D. Use Form 19 for final settlement, Form 31 for partial EPF withdrawal, Form 10C for pension withdrawal, and Form 10D for monthly pension withdrawal.

Frequently Asked Questions

A. The EPF balance will be credited to your bank account within 20 days of submitting Form 19.

A. Report the issue to the Regional Provident Fund Commissioner or file a complaint on the EPF website using the ‘EPFIGMS’ feature under the ‘For Employees’ tab.

A. No, if your UAN is active and KYC is complete, your employer’s consent is not required to withdraw EPF funds.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.