Understanding EPF Form 2 Part A: A Detailed Overview

The Employees’ Provident Fund (EPF) scheme is a critical social security initiative in India, designed to provide financial stability to employees post-retirement or in case of unforeseen circumstances. EPF Form 2 is a crucial document within this scheme, and Part A of this form plays a particularly vital role. This section is dedicated to the nomination process, which determines who will receive the accumulated EPF funds in the event of the employee’s demise.

Purpose of EPF Form 2 Part A

Part A of Form 2 is used by employees to nominate one or more individuals as beneficiaries for the Provident Fund (PF) and the Employees’ Deposit Linked Insurance (EDLI) scheme. This ensures that in case of the unfortunate death of the employee, the funds are disbursed to the intended beneficiaries without any legal complications or delays.

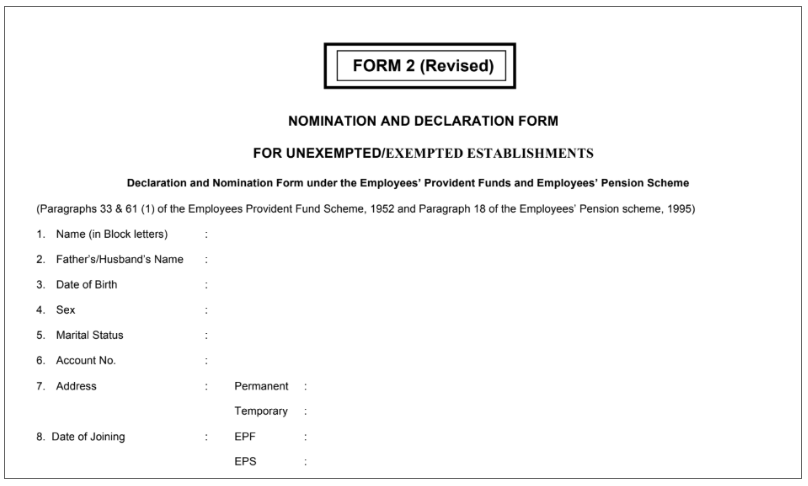

Components of EPF Form 2 Part A

EPF Form 2 Part A consists of several key fields that need to be carefully filled out by the employee. These include:

Nominee Details:

- Name and Address of the Nominee(s): The employee must provide the full name and address of each nominee.

- Relationship with the Member: It’s important to specify the relationship of each nominee to the employee (e.g., spouse, child, parent).

- Date of Birth of the Nominee(s): This is essential to ensure the identity of the nominee and to determine the legal eligibility in case of minors.

Share of PF Amount:

- The employee must clearly state the percentage of the EPF amount that each nominee is entitled to. This division can be equal or varied depending on the employee’s preference.

Guardian Details (if the nominee is a minor):

- If the nominee is under the age of 18, the employee must provide the name and address of the guardian who will manage the funds on behalf of the minor until they reach the age of majority.

Signature or Thumb Impression:

- Finally, the form must be authenticated by the employee’s signature or thumb impression to validate the nominations.

Importance of Updating Nominee Details

It is critical for employees to keep the nominations updated, particularly after significant life events such as marriage, the birth of a child, or the death of a previously nominated individual. Regularly updating these details ensures that the employee’s funds are distributed according to their most current wishes.

Legal Implications

The nomination made in Part A of Form 2 is legally binding. In the absence of a valid nomination, the distribution of the EPF funds may be subject to legal disputes among potential heirs, causing unnecessary delays and distress to the family members. Therefore, correctly filling out and updating Part A of Form 2 is not just a procedural requirement but a safeguard for the employee’s family.

Filing and Submission Process

Online Filing:

- Employees can file their nominations online via the EPF Member Portal, using their Universal Account Number (UAN). The process involves selecting nominees, entering their details, and specifying the share of the EPF corpus each nominee is entitled to.

Offline Filing:

- Alternatively, employees can download Form 2, fill out the nomination details in Part A, and submit it to their employer. The employer then forwards the form to the EPFO (Employees’ Provident Fund Organisation) for record-keeping.

No Limitation on Updates

There is no restriction on the number of times an employee can update their nominations. This flexibility ensures that employees can always have the most appropriate and current individuals as beneficiaries.

Conclusion

EPF Form 2 Part A is a critical aspect of the Provident Fund scheme, ensuring that an employee’s hard-earned savings are passed on to their chosen beneficiaries. Properly understanding and completing this form is essential for safeguarding the financial future of one’s dependents. Employees are encouraged to fill out this form diligently and update it as necessary to reflect changes in their personal circumstances.

Frequently Asked Questions

A: EPF Form 2 Part A is used by employees to nominate beneficiaries for their Provident Fund (PF) account. In the event of the employee’s death, the nominated individuals are entitled to receive the accumulated PF amount.

A: Form 2 Part A should be filled out when you first join a company and enroll in the EPF scheme. It is also recommended to update the form after any significant life events, such as marriage, to ensure that your nominations are current.

A: If you have family members, the nomination must be in their favor. If you do not have a family, you are free to nominate any person of your choice. However, once you have family members, the nomination should be updated to include them.

A: No, there are no additional documents required when filling out EPF Form 2 Part A. The form itself is sufficient to declare your nominations.

A: There is no limit to how many times you can update your nominations in Form 2 Part A. You can change your nominations whenever necessary, ensuring that your nominations reflect your current preferences.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.