Understanding the Notice Under Section 142(1) of the Income Tax Act

Introduction: What is a Notice Under Section 142(1)?

Once you have filed your Income Tax Return (ITR), the Income Tax Department may conduct an assessment to ensure the accuracy and completeness of the return filed. If the Assessing Officer (AO) needs more information or clarification regarding specific details in your return, they may issue a notice under Section 142(1) of the Income Tax Act (ITA).

Purpose of the Notice Under Section 142(1):

A notice under Section 142(1) serves multiple purposes:

Filing of Income Tax Return: If you have not filed your return within the stipulated time, the AO may require you to do so. This could include filing a return for your income or for income that you are responsible for, such as that of a minor or a deceased person.

Submission of Documents: The AO may ask for specific documents or accounts that will help in making a proper assessment of your income and tax liability.

Providing Additional Information: You may be required to furnish other relevant information or statements, such as a detailed list of assets and liabilities as of a certain date.

Mandatory Compliance with Section 142(1):

Compliance with a notice under Section 142(1) is mandatory, regardless of whether you believe the requested documents or information are necessary. Failing to comply can result in several consequences:

- Best Judgment Assessment (Section 144): The AO may proceed with a best judgment assessment, determining your income and tax liability based on the information available, which could lead to a higher tax demand.

- Penalties: A penalty of ₹10,000 may be levied for each failure to comply (Section 271(1)(b)).

- Prosecution: In severe cases, prosecution under Section 276D may result in imprisonment for up to a year, along with a fine.

If the AO is satisfied with the documents or explanations provided, they may not pursue further assessment, and the proceedings will be closed.

Faceless Assessment Scheme, 2019:

The Central Board of Direct Taxes (CBDT) has introduced the ‘Faceless Assessment Scheme, 2019’ (earlier known as ‘e-Assessment Scheme’), where all assessments are conducted electronically, without requiring physical interaction between taxpayers and the tax department, except for specific cases. Under this scheme, the National e-Assessment Centre (NeAC) manages the entire process, ensuring a fair and transparent assessment.

Steps in the Faceless Assessment Process:

Issuance of Notice by NeAC:

The NeAC issues a notice to the taxpayer, who is required to respond within 15 days. The case is then assigned to an Assessment Unit (AU) in one of the Regional e-Assessment Centres (ReAC) through an automated system.Information Gathering and Verification:

The AU may request the NeAC to obtain additional documents, evidence, or technical assistance. The NeAC will issue further notices to the taxpayer or assign tasks to a Verification Unit (VU) or Technical Unit (TU).Draft Assessment Order:

If the taxpayer fails to comply, NeAC issues a show-cause notice (SCN) under Section 144, asking why a best judgment assessment should not be completed. Depending on the taxpayer’s response, NeAC may proceed with finalising the order, seeking modifications, or forwarding the draft order to a Review Unit (RU).Review and Finalisation:

The RU reviews the draft assessment order, either concurring or suggesting modifications. NeAC finalises the assessment order based on this review, or if necessary, involves another AU for modifications.Final Order:

The NeAC finalises the order after considering all inputs, ensuring transparency and fairness throughout the process. If modifications are proposed, taxpayers are given an opportunity to be heard.

How to Respond to a Notice Under Section 142(1):

Responding to a notice under Section 142(1) must be done electronically via the ‘e-Proceedings’ section on the Income Tax Department’s e-filing portal. Follow these steps:

Log In to the Income Tax Portal:

Visit www.incometax.gov.in and log in using your credentials (PAN/Aadhaar and password).Navigate to ‘Pending Actions’:

Go to the ‘Pending Actions’ tab and select ‘E-Proceedings.’View and Respond to the Notice:

Click on ‘View Notices’ and then ‘Submit Response.’ You will need to choose between ‘Partial Response’ or ‘Full Response’ and upload the required documents in PDF, Excel, or CSV format.Complete and Submit:

After uploading the necessary documents, check the declaration box and click ‘Submit.’ You will receive an acknowledgment of successful submission.

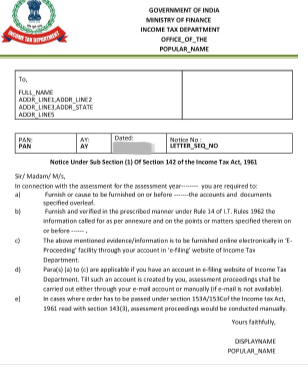

This Is How a Notice Under Section 142(1) Looks Like:-

Frequently Asked Questions

A: You are generally required to respond within 15 days from the date of receiving the notice, but this period can vary depending on the specific instructions in the notice.

A: Yes, you can request an extension, but it is at the discretion of the Assessing Officer, who may grant it if a valid reason is provided.

A: Even if you disagree with the relevance of the requested information, you are required to comply. You can provide an explanation for your disagreement, but non-compliance can lead to penalties.

A: You can file a revised return if the time limit for revision has not expired. Otherwise, you must respond to the notice directly.

A: Failure to respond may result in a best judgment assessment, penalties, or prosecution, depending on the circumstances.

A: No, the Assessing Officer (AO) is restricted from requesting information or documents that date back more than three years. This means that any demand for records or details under Section 142(1)(ii) must be limited to the past three years only.

A: If the deadline for responding is approaching and you lack some of the necessary documents or details, it is advisable to file a partial response. This demonstrates your compliance with the notice and indicates that you require additional time to provide the remaining information. After a partial response, the tax department may issue another notice allowing you to submit any additional documents or details at a later date.

A: When dealing with complex or voluminous accounts, questionable accuracy, numerous transactions, or specialized business activities, the Income Tax Officer has the authority to direct the taxpayer to:

- Have their books of accounts audited by a Chartered Accountant.

- Obtain a stock valuation from a Cost and Works Accountant.

These measures are intended to ensure accurate reporting and safeguard the interests of revenue.

About The Author

Gagan Gupta

Founder & CEO

Gagan Gupta is a distinguished authority in the realm of accounting and tax compliance. With extensive expertise in managing comprehensive tax compliance procedures—ranging from income tax and GST to TDS and TCS filings across various industries—Gagan has established himself as a pivotal figure in the field. His proficiency extends to meticulously teaching the intricacies of the filing process, elucidating even the most minute details, and identifying common errors along with their resolutions.

Gagan Gupta’s profound understanding of every facet of taxation and accounting enables him to share invaluable insights through industry-specific blogs. These blogs serve as a rich resource for fellow industry professionals, including advocates and Chartered Accountants (CAs). By imparting his extensive knowledge and practical experience, Gagan Gupta not only enriches his readers but also contributes significantly to the broader discourse in the taxation and finance community.