Maximizing Every Dollar Expert US Tax Filing Services

Your Trusted Partner for Precise Tax Handling

At Covering Taxes, we specialize in offering comprehensive US tax filing services tailored for clients at minimal costs, ensuring maximum efficiency and accuracy. Our individual tax filing services encompass the complete preparation and submission of the 1040 Federal Tax Return, a state tax return, and up to two W-2 forms, including considerations for Married Filing Jointly (MFJ) and other scenarios based on client information. Our expertise extends to US business tax filing, accommodating various business structures such as partnerships, S-corporations, multi-member LLCs, and more. Compliant with IRS laws and regulations, we provide reliable and effective solutions for all your US tax needs.

Advantages of Choosing Our Services

Essential Documents for US Tax Filing

US Individual Tax Filing:

Form W-2 (Wage and Tax Statement) ,Form 1099 (for additional income) Proof of other income (rental, investment, etc.) ,Identification documents (SSN, ITIN) ,Deductions and credits documentation (mortgage interest, student loans, charitable contributions)

US Business Tax Filing:

Business income statements (P&L, balance sheet),Partnership agreements or incorporation documents, Employer Identification Number (EIN) ,Records of expenses (receipts, invoices) Previous year's tax returns

NRI Tax Filing:

Foreign income statements ,Tax residency certificates ,Proof of investments and assets abroad ,Bank statements ,Relevant forms and documents per IRS requirements (Form 8938, FBAR)

Accurate and Affordable US Tax Return Filing

Assisted/ Individual

Ensuring accuracy for incomes, deductions, families, interest, and dividend income.

- Prices Include:

- 1040 Federal Tax Return

- 1 State Tax Return

- Up-to 2 W-2 considering MFJ

- Pay Extra 50 Dollars For Live Filing

ASSISTED/BUSINESS

Professional Tax Services for Small Businesses certified experts handling your business tax preparation.

- Prices Include:

- Partnerships

- S-corps

- Multi-member LLC

- Pay Extra 50 Dollars For Live Filing

Please note that the quoted fees are exclusive of any accounting or reconciliation services that may be required. The estimate assumes that you will provide tax-ready accounting records and reports. Each tax scenario is unique, and the final pricing will depend on individual circumstances.

Frequently Asked Questions

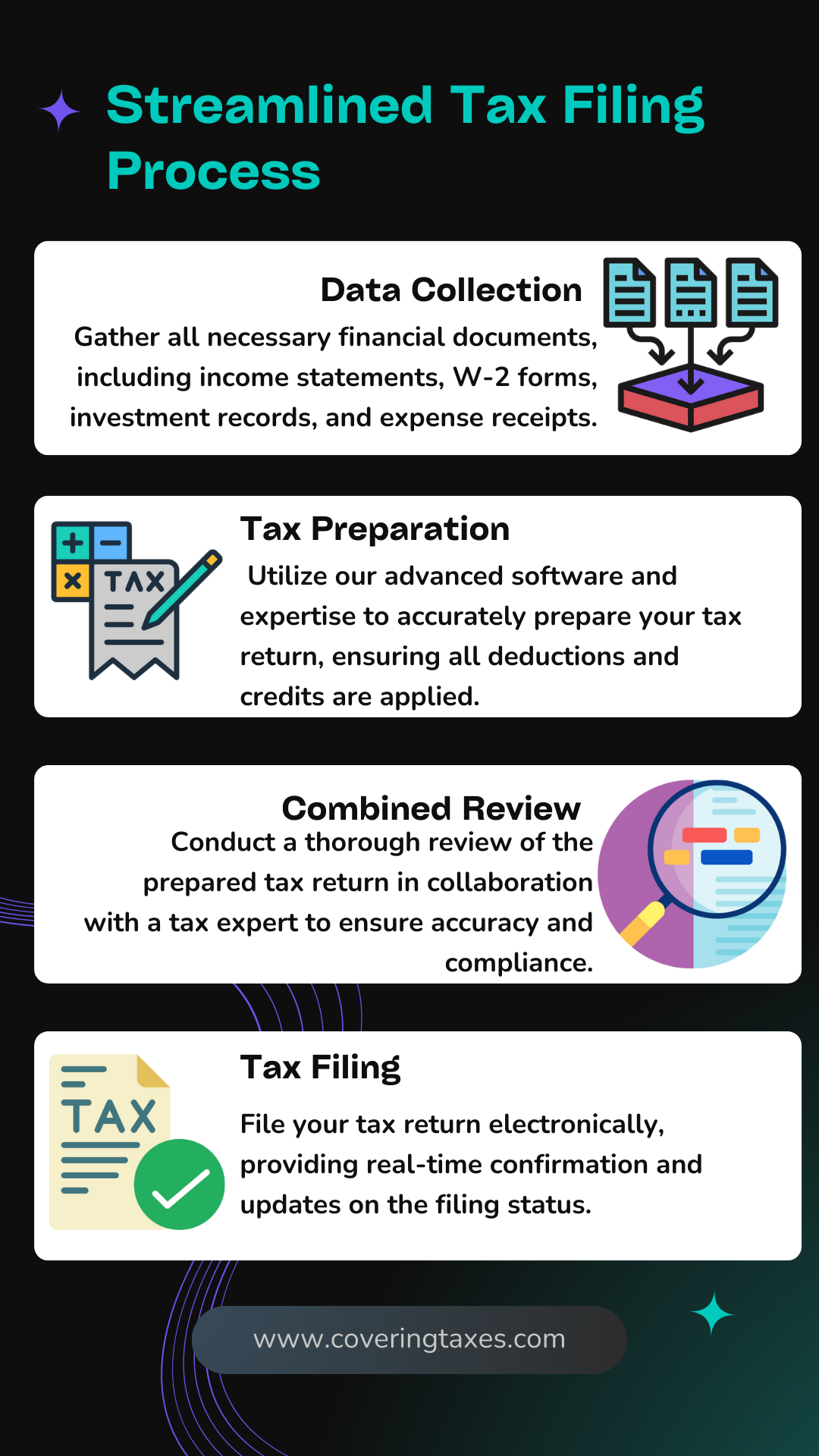

Our typical processing time is up to three business days. We prioritize quality over speed, ensuring that every tax return is meticulously prepared. Unlike other firms, our approach involves collaboration; each preparer at Covering Taxes (whether EA or CPA) works closely with a supervising CPA or EA. This dual-review process guarantees that your return is prepared accurately and in the most advantageous manner for you.

Absolutely. Your tax return will not be filed until you have reviewed and approved it. During the preparation process, we will ask for your feedback, including any questions or changes you might have. We will address each of your inquiries and make the necessary adjustments until you are satisfied with the outcome, ensuring that all tax positions comply with the Internal Revenue Code.

We prioritize e-filing your tax return whenever possible and will provide a confirmation document once it’s done. However, in some instances, the IRS may require a physical submission with a wet signature. If this situation arises, we will supply you with detailed instructions on how to mail your return to the IRS.

Absolutely. Our goal is to simplify the tax filing process for you, making it fully accessible through our website and email communications.

Yes, we fully support the work we do. If the IRS ever questions a return we’ve prepared, we will review their correspondence and advise you on the appropriate course of action.

Specifically:

- Error on Our Part: If we made an error on your return, we will file an amended return at no additional cost. This scenario is exceedingly rare.

- Correct Return, IRS Questions: If the return is accurate but the IRS has questions, we will guide you on the simplest way to address their inquiry, which may involve a phone call or a written response.

- Client-Provided Information Issues: If the IRS disputes the figures you provided (e.g., omitted income from stock sales), we can prepare an amended return for you. This service would be chargeable as the initial information provided was incorrect.

Have Us Call You

Disclaimer!

The content provided on our website, Covering Taxes India, serves as informational guidance to enhance your understanding of taxation matters. However, it’s important to note that any actions taken based on this information should be accompanied by personalized advice from our team of tax experts. The information provided on Covering Taxes India does not establish a professional relationship nor constitute formal advice. We emphasize that Covering Taxes India holds no liability for any consequences resulting from actions taken in reliance on the information provided on our website or through links to third-party sites. Additionally, any federal tax advice contained in this communication, including attachments, is not intended for the purpose of evading penalties imposed by governmental taxing authorities.